字幕與單字

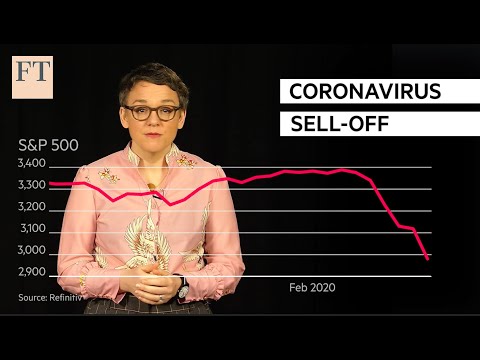

冠狀病毒:市場是如何醒悟過來的? (Coronavirus: how markets woke up to the threat | FT)

00

林宜悉 發佈於 2021 年 01 月 14 日收藏

影片單字

tough

US /tʌf/

・

UK /tʌf/

- adj.(肉等)老的;咬不動的;堅韌的:艱苦的:困難的;強硬的;嚴格的;堅韌的;不屈不撓的;棘手的;費勁的;剛強的

- n.硬漢

- v.t.使變堅強

- v.t./i.忍受

A2 初級中級英檢

更多 使用能量

解鎖所有單字

解鎖發音、解釋及篩選功能