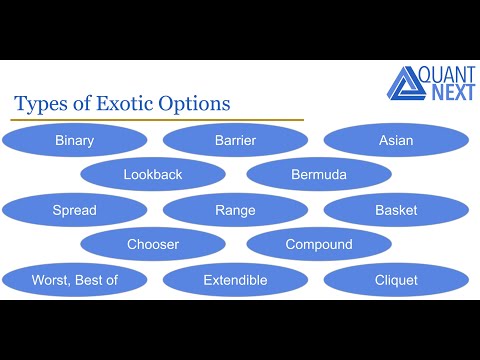

奇異期權--第一部分 (Exotic Options - Part I)

sweebin khor 發佈於 2024 年 09 月 23 日  沒有此條件下的單字

沒有此條件下的單字US /spɪˈsɪfɪk/

・

UK /spəˈsɪfɪk/

US /ˈpɪriəd/

・

UK /ˈpɪəriəd/

- n. (c./u.)時期;(用於句末;表示斷定的口氣)就這樣;句號;月經;期間

US /ˌɡærənˈti/

・

UK /ˌɡærən'ti:/

- v.t.保修;保證;保證;法律保障

- n. (c.)(某產品的)保固;保證某事的如期完成;擔保

- v.i.是重要的

- n. (u.)物質

- n.件事情;問題;原因