字幕與單字

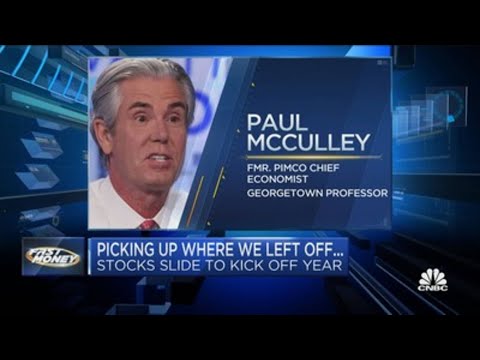

McCulley對下一季的投資建議('Buy cheap and out of favor' this quarter, says Paul McCulley, fmr. PIMCO chief economist)

00

WP 發佈於 2023 年 01 月 04 日收藏

影片單字

process

US /ˈprɑsˌɛs, ˈproˌsɛs/

・

UK /prə'ses/

- v.t.用電腦處理(資料);(依照規定程序)處理;處理;流程;加工;理解

- n. (c./u.)(規定的)程序;過程;進程;方法;法律程序;進程

A2 初級多益中級英檢

更多 使用能量

解鎖所有單字

解鎖發音、解釋及篩選功能