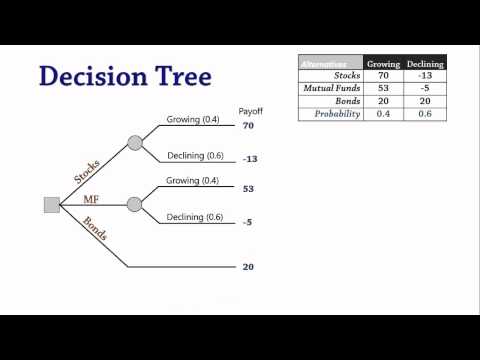

決策分析3:決策樹 (Decision Analysis 3: Decision Trees)

沒有此條件下的單字

沒有此條件下的單字US /əˈprəʊtʃ/

・

UK /ə'prəʊtʃ/

- v.t./i.逼近;找...商量

- n. (c./u.)通道;入口;接洽;處理方式;方法

US /ɔlˈtɚnətɪv, æl-/

・

UK /ɔ:lˈtɜ:nətɪv/

US /ɪkˈspɛkt/

・

UK /ɪk'spekt/

US /ˌrɛprɪˈzɛnt/

・

UK /ˌreprɪ'zent/

- v.t.具象派的;象徵;表示;代表(政府機關);當...代表