字幕與單字

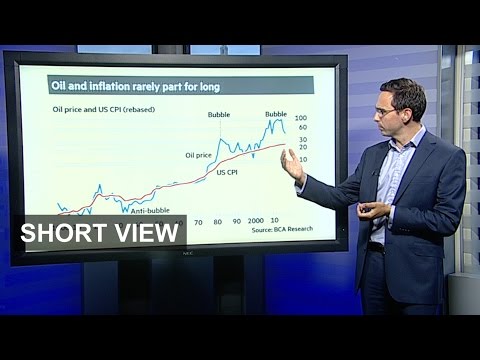

大宗商品價格上漲不可避免的死亡|短線看法 (Inevitable death of commodity price inflation | Short View)

00

Noppe 發佈於 2021 年 01 月 14 日收藏

影片單字

close

US /kloʊz/

・

UK /kləʊz/

- adj.接近的;(關係)密切的;親密的;接近;;近的;接近的;悶熱的;勢均力敵的

- v.t./i.接近;結束;終止;截止;關閉;完成;封鎖

- adv.靠近地

- n.結束

A1 初級初級英檢

更多 使用能量

解鎖所有單字

解鎖發音、解釋及篩選功能