字幕與單字

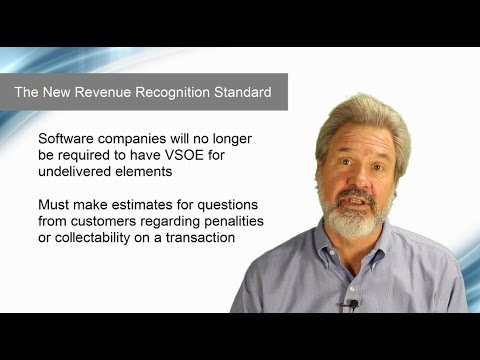

新的收入確認標準--對您有什麼影響? (The New Revenue Recognition Standard - How Does it Affect You?)

00

張金明 發佈於 2021 年 01 月 14 日收藏

影片單字

current

US /ˈkɚrənt, ˈkʌr-/

・

UK /'kʌrənt/

- n. (u.)電流;流量;流通貨幣

- adj.目前的;通用的;被普遍接受的;有效的;最新的

- n.趨勢;潮流;輿論

A2 初級初級英檢

更多 使用能量

解鎖所有單字

解鎖發音、解釋及篩選功能