字幕與單字

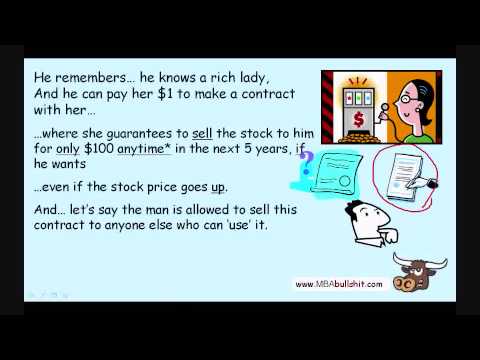

看漲期權交易的初學者在9分鐘。 (Call Options Trading for Beginners in 9 min. - Put and Call Options Explained)

00

Alec 發佈於 2021 年 01 月 14 日收藏

影片單字

call

US /kɔl/

・

UK /kɔ:l/

- n.呼喚;召喚;叫聲;判定;判決;拜訪;短時間逗留;(裁判的)判決

- v.t./i.罷工;拜訪某人;拜訪某地;打電話;叫喊;大叫;大喊

- v.i.叫喊;呼叫

- v.t.舉行選舉;召集會議;判決;稱為;叫作;判定

A1 初級初級英檢

更多 使用能量

解鎖所有單字

解鎖發音、解釋及篩選功能