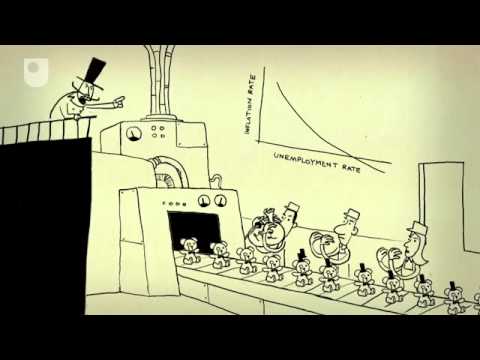

60 秒經濟學之旅!一起踏上學習「經濟學」的旅程吧! (60 Second Adventures in Economics combined - CAPTIONED)

Eating 發佈於 2024 年 05 月 10 日  沒有此條件下的單字

沒有此條件下的單字US /ædˈvæntɪdʒ/

・

UK /əd'vɑ:ntɪdʒ/

- n. (c./u.)優勢;優點;利益

- v.t.利用;佔便宜

- n.地點,處所;處於困境,陷入困境;點;少量,少許;斑點,污漬

- v.t.認出,發現

US /dɪˈmænd/

・

UK /dɪ'mɑ:nd/

- n. (c./u.)需求;請求,請求;需求;法律要求

- v.t.請求;需要

US /ˈræʃənəl/

・

UK /'ræʃnəl/