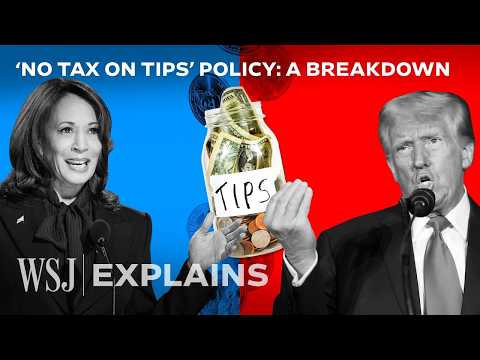

賀錦麗和川普的「免小費」政策為何引發爭議? (Why Harris and Trump’s ‘No Tax on Tips’ Policy Is So Controversial | WSJ)

VoiceTube 發佈於 2024 年 09 月 11 日  沒有此條件下的單字

沒有此條件下的單字US /ɪˈlɪməˌnet/

・

UK /ɪ'lɪmɪneɪt/

US /kæmˈpen/

・

UK /kæm'peɪn/

- v.i.領導運動

- n. (c./u.)(尤指政治、商業或軍事的)專門活動,運動;軍事行動;(政治或商業)活動

- v.t.推廣

US /ɪkˈspɛkt/

・

UK /ɪk'spekt/

US /əˈprɑksəmɪtlɪ/

・

UK /əˈprɒksɪmətli/