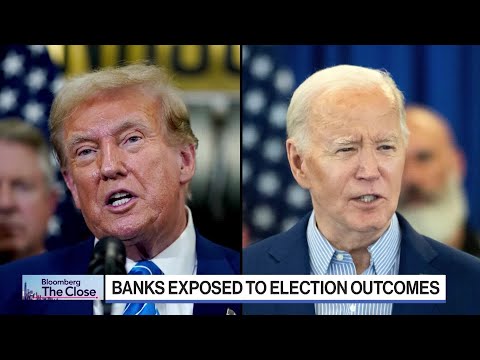

誰對銀行更有利?拜登還是特朗普? (Who's Better for Banks: Biden or Trump?)

Mia Na 發佈於 2024 年 07 月 19 日  沒有此條件下的單字

沒有此條件下的單字US /pɚˈspɛktɪv/

・

UK /pə'spektɪv/

- n. (c./u.)透視;觀點,態度;觀點;恰當的比重

US /spɪˈsɪfɪk/

・

UK /spəˈsɪfɪk/

US /ˈdɛlɪkɪt/

・

UK /'delɪkət/

US /ˈbesɪkəli,-kli/

・

UK /ˈbeɪsɪkli/