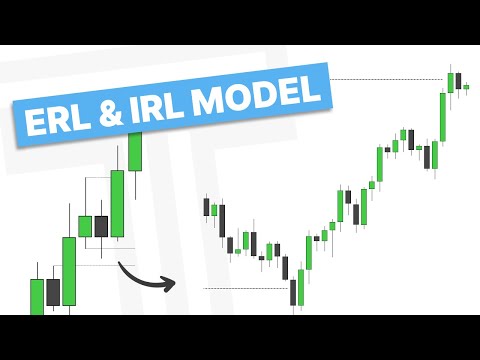

內部和外部流動性模型 - ICT 概念 (Internal & External Liquidity Model - ICT Concepts)

q ain 發佈於 2024 年 06 月 20 日  沒有此條件下的單字

沒有此條件下的單字- n. (c./u.)範本;典範;圖案;花樣;模式;方式;規律;紙樣

- v.t.仿造;用圖案裝飾

US /ˈstrʌk.tʃɚ/

・

UK /ˈstrʌk.tʃə/

- n. (c./u.)結構;建築物

- v.t.構成;組織

US /əˈɡrɛsɪv/

・

UK /əˈgresɪv/

- adj.激進;侵略性的;(疾病)快速發展的;積極的

- n. (c./u.)偏見;成見;偏差;偏袒

- v.t.偏壓;使有偏見;施加偏壓