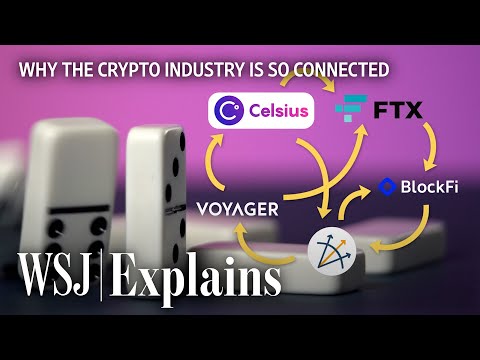

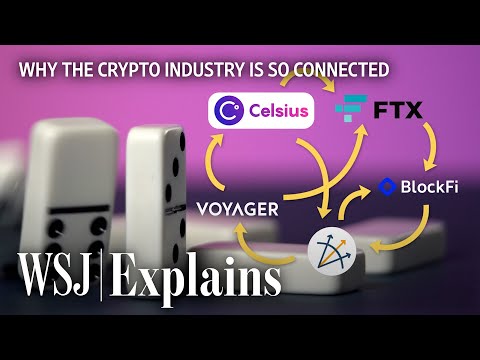

為什麼加密貨幣的崩潰沒有波及到其他市場(Why Crypto’s Crash Hasn’t Spilled Into Other Markets | WSJ)

Kelly Lin 發佈於 2023 年 05 月 11 日  沒有此條件下的單字

沒有此條件下的單字US /pəˈtɛnʃəl/

・

UK /pəˈtenʃl/

- adj.可能的;潛在的;潛在的

- n. (u.)潛力,潛能

- n. (c./u.)潛力;潛能;潛在候選人;勢

- adj.巨大的;大而重的;大量的;厚重的;大規模的

US /ˈkraɪsɪs/

・

UK /'kraɪsɪs/

US /ɪkˈspoʒɚ/

・

UK /ɪk'spəʊʒə(r)/

- n.未經照射的 ; 未曝光的;曝光;揭露(某事);揭發(某事);曝露;暴露;曝曬;(醫療)失溫;暴露;(金融)風險承擔