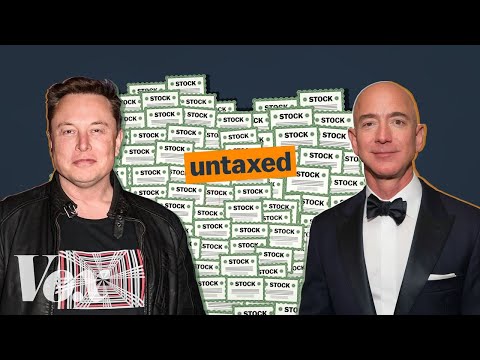

富者為何更富?錢越多稅金越低?一起來看看美國稅法如何讓富者不用繳稅!(How the rich avoid paying taxes)

Misaki 發佈於 2023 年 01 月 02 日  沒有此條件下的單字

沒有此條件下的單字US /ˈrevənju/

・

UK /'revənju:/

- n. (c./u.)收益;稅收;收入;稅務局;營業收入

US /ˈædvəˌket/

・

UK /'ædvəkeɪt/

- n. (c./u.)辯護人;律師;提倡者;擁護者

- v.t./i.主張;擁護;支持;提倡

US /ɪnˈkris/

・

UK /ɪn'kri:s/

- v.t./i.增長;增加

- n. (c./u.)增加;增強

US /ɪkˈsplɔɪt/

・

UK /ɪk'splɔɪt/

- v.t.利用;開發利用

- n. (c./u.)探險;功績