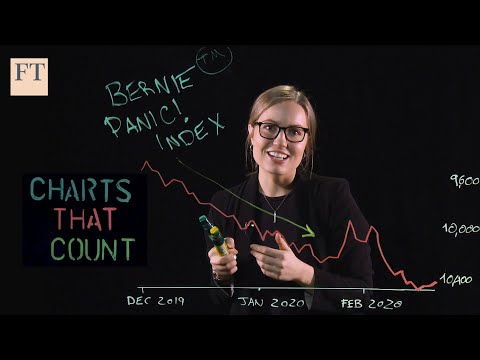

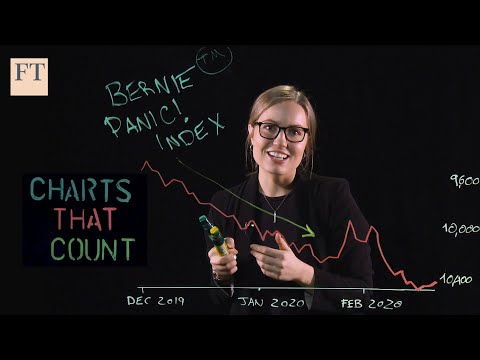

伯尼-桑德斯的 "恐慌指數"|數得著的圖表。 (The Bernie Sanders 'panic index' | Charts that Count)

沒有此條件下的單字

沒有此條件下的單字US /pəˈtɛnʃəl/

・

UK /pəˈtenʃl/

- adj.可能的;潛在的;潛在的

- n. (u.)潛力,潛能

- n. (c./u.)潛力;潛能;潛在候選人;勢

US /ˈævərɪdʒ, ˈævrɪdʒ/

・

UK /'ævərɪdʒ/

- n. (c./u.)平均

- v.t.算出...的平均數

- adj.平均的;一般的,通常的;中等的