字幕與單字

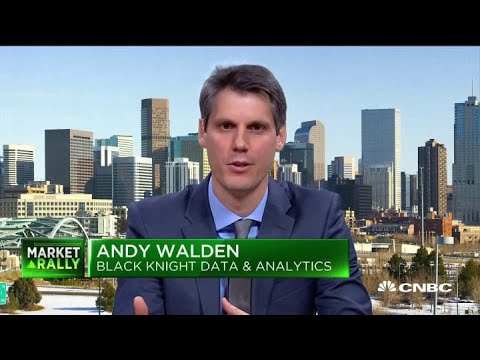

利率下降可以刺激已經升溫的房市。市場研究人員 (Declining interest rates can spur an already heating housing market: Market researcher)

00

林宜悉 發佈於 2021 年 01 月 14 日收藏

影片單字

potential

US /pəˈtɛnʃəl/

・

UK /pəˈtenʃl/

- adj.可能的;潛在的;潛在的

- n. (u.)潛力,潛能

- n. (c./u.)潛力;潛能;潛在候選人;勢

A2 初級多益中級英檢

更多 使用能量

解鎖所有單字

解鎖發音、解釋及篩選功能