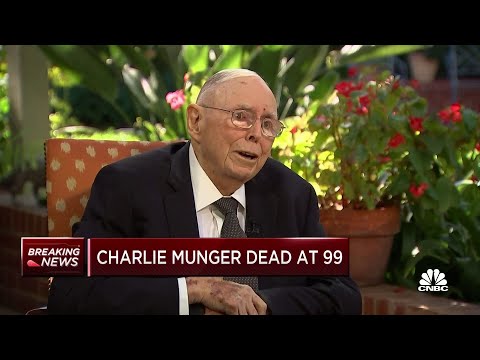

查理-芒格沃倫和我創業之初,'我從未想過我們能達到 1000 億美元'。 (Charlie Munger: When Warren and I were starting 'I never thought we would ever get to $100 billion')

沒有此條件下的單字

沒有此條件下的單字US /ɪˈvɛntʃuəli/

・

UK /ɪˈventʃuəli/

US /ˈdisənt/

・

UK /ˈdi:snt/

- adj.正派的; 得體的;正派的;慷慨的;穿著得體的;相當可觀的

- v.t./i.出現;估計;我認為〜;認為

- n.身影;(計算過的)數量;肖像;圖;形狀;人物;名人;人影;數字